Orkla IPO allotment status has been finalized on November 3, 2025, and investors can now check their allotment details online through the official websites of NSE, BSE, and KFin Technologies. Orkla India, formerly MTR Foods, is a well-known multi-category Indian food company offering spices, ready-to-eat products, sweets, and breakfast mixes under brands like MTR, Rasoi Magic, and Eastern. The IPO saw an overwhelming subscription of 48.73 times, reflecting strong investor interest.

Orkla India IPO Allotment Live Updates: Direct links to check status online

Orkla India IPO Allotment Live Updates: If you have applied for the Orkla India IPO, you can check your allotment status online using the links provided below.

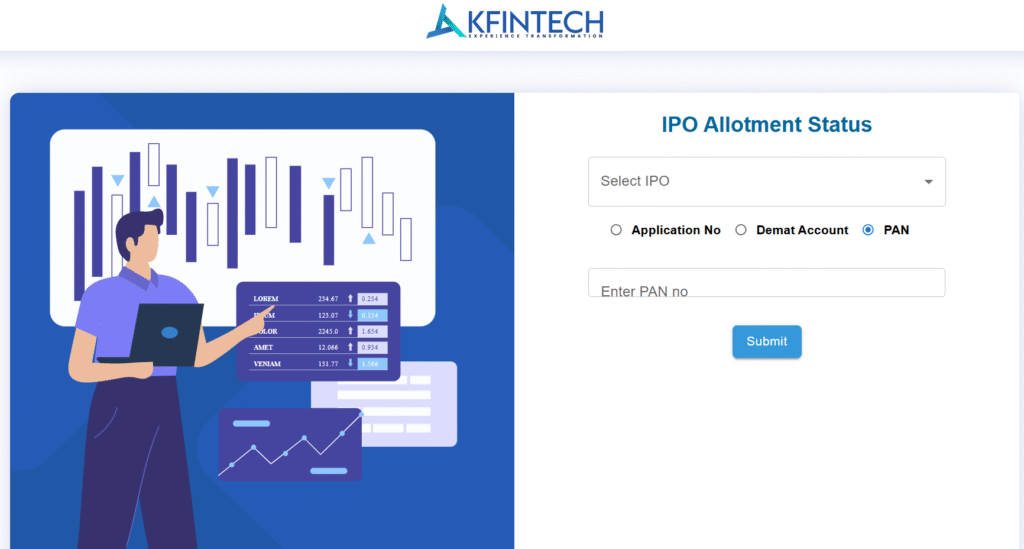

- KFin Technologies: https://ipostatus.kfintech.com/

To check the IPO allotment status:

- Investors can visit the websites of NSE, BSE, or KFin Technologies.

- The allotment is based on a lot size of 20 shares.

- Subscription category-wise, Qualified Institutional Buyers subscribed 117.63 times, Non-Institutional Investors 54.42 times, and Retail Investors 7.05 times.

- The IPO price band was set between ₹695 and ₹730 per share.

This IPO’s allotment status finalization brings clarity for investors on their share allocations after a highly subscribed public offer. Detailed steps to check allotment on NSE or KFin websites are provided for convenience.

Here is a complete SEO-optimized news post based on this update:

Orkla India IPO Allotment Status 2025: Check Live Updates and How to Verify Your Share Allocation

The much-anticipated Orkla India IPO allotment status has been finalized on November 3, 2025. Investors who applied for this highly subscribed IPO can now check their allotment details online on the official platforms of NSE, BSE, and KFin Technologies. This article covers everything you need to know about the Orkla India IPO allotment process, subscription statistics, price band, and step-by-step guides on how to check your status.

About Orkla India and Its IPO

Orkla India, previously known as MTR Foods, is a leading Indian food company offering a diversified product portfolio including spices, ready-to-eat meals, sweets, and breakfast mixes. Popular brands under Orkla India are MTR, Rasoi Magic, and Eastern. The company entered the public market with strong investor anticipation, reflected in an overall IPO subscription of 48.73 times.

IPO Subscription Details

- Qualified Institutional Buyers (QIBs): Subscribed 117.63 times

- Non-Institutional Investors (NIIs): Subscribed 54.42 times

- Retail Investors: Subscribed 7.05 times

- Total Subscription: 48.73 times

The high subscription levels indicate robust market confidence and demand for Orkla India shares.

Price Band and Lot Size

- Price Band: ₹695 to ₹730 per share

- Lot Size: 20 shares per application

How to Check Orkla India IPO Allotment Status Online

Investors can conveniently verify their IPO allotment status using the following methods:

On NSE Website

- Visit the official NSE website.

- Navigate to the IPO section.

- Select Orkla India IPO allotment status.

- Enter your PAN or application number to view status.

On BSE Website

- Visit the BSE website.

- Find the IPO allotment link for Orkla India.

- Input required credentials to check allotment.

On KFin Technologies Website (Registrar)

- Go to KFin Technologies Limited official site.

- Click on IPO allotment status.

- Provide your PAN or application details for status.

Importance of Allotment Status

The allotment status confirms whether the investor has been allocated shares in the IPO and the number of shares allotted. With Orkla India IPO strongly oversubscribed, allotment is crucial for investors to plan their next steps, whether it is listing day trading or long-term holding.

Final Words

Orkla India’s successful IPO and strong subscription along with the allotment finalization today mark a significant milestone for this prominent Indian food company. Investors are encouraged to check their allotment at the earliest to stay updated.

- Epstein Files: 2026’s Massive 3-Million-Page Disclosure and Its Global Impact

- Union Budget 2026: Key Highlights, New Tax Slabs, and Sectoral Impact

- Toxic Movie Teaser Out: Rocking Star Returns as Raya in High-Octane ‘Fairytale for Grown-Ups’

- PDF4me is the Best Free All-in-One Tool of 2026

- Venezuela Crisis 2026