Lenskart has launched one of the most anticipated IPOs of 2025, aiming to raise ₹7,278 crore, with a price band of ₹382–₹402 per share. The issue opened for subscription on October 31 and will be available until November 4, with listings expected around November 10, 2025. The company’s recent return to profitability and strong business model have made it a focus for investors, but high valuations have sparked debate about its long-term value and listing gains.

Lenskart IPO Key Details

- IPO Size: ₹7,278 crore (₹2,150 crore fresh issue + ₹5,128 crore OFS)

- Price Band: ₹382–₹402 per share

- Lot Size: 37 shares (minimum investment about ₹14,874)

- Listing Date: November 10, 2025 (tentative)

- Market Valuation: Around ₹70,000 crore at the upper price band

- Grey Market Premium (GMP): ~₹70 per share, indicating a ~17% listing premium; GMP has moderated from earlier highs reflecting some caution.

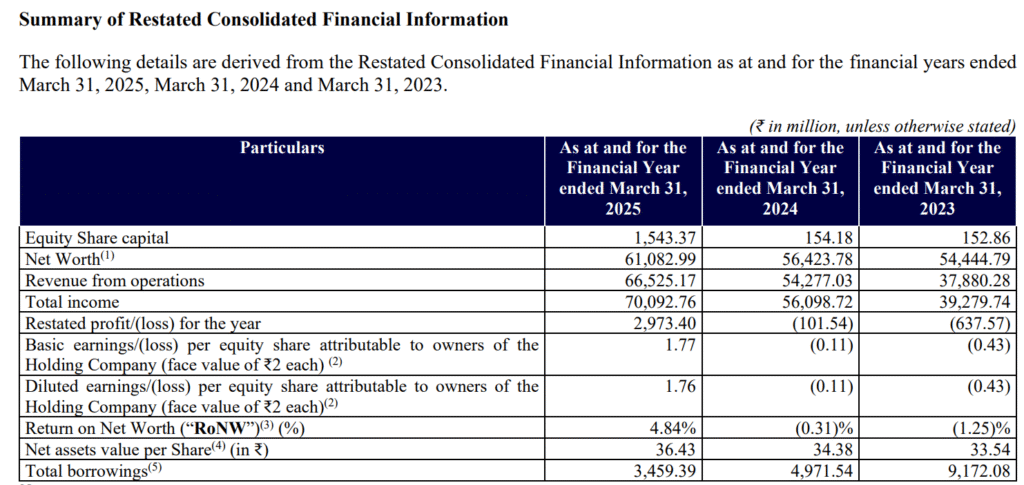

Lenskart’s Profit and Loss

- FY25 Net Profit: ₹296–₹297 crore, after losses in FY23 and FY24

- Revenue Growth: Grew from ₹3,788 crore in FY23 to ₹6,652 crore in FY25, a CAGR of 32.5%

- EBITDA Margin: Improved from 6.9% to 14.7% between FY23 and FY25

- First year of profitability (FY25) after prior years of losses.

GMP & Subscription Sentiment

- Current GMP: ₹70 per share; reflects possible ~17% premium on listing.

- Early GMP had been higher (~₹108) but moderated due to valuation concerns and market sentiment cooling.

Should You Apply?

- Analyst View: Many analysts recommend applying for the long term due to Lenskart’s leadership, revenue growth, omnichannel model, and profitability turnaround.

- Risks: Extremely high P/E (around 235–238x FY25 profit) makes this an expensive IPO by Indian standards. Success beyond listing-day pop will require sustained earnings growth, margin expansion, robust execution, and continued consumer demand.

- Retail Strategy: Subscription is available via ASBA or UPI, easiest through your broker or net banking.

- Lenskart is now profitable, but growth is mainly India-centric, and competition in eyewear is intense. The IPO is relatively expensive, so expect moderate listing gains and evaluate for long-term holding if you believe in the sector and company.

Key and Required IPO Application Details

- Minimum Investment: 1 lot = 37 shares = ₹14,874.

- Lead Managers: Kotak, Morgan Stanley, Citigroup, Avendus, Axis, Intensive Fiscal.

- Registrar: MUFG Intime India.

- What Makes a Good/Profitable IPO?

Conclusion

Lenskart’s IPO offers exciting prospects backed by profitability and strong market share, but its high valuation tempers expectations for easy listing gains. For investors aiming at long-term growth in India’s consumer-tech segment, it is a candidate to consider, albeit with realistic expectations and attention to post-listing performance.

Disclaimer: Invest only after reading the full DRHP, considering your risk appetite and financial goals, and reviewing analyst recommendations.

- Epstein Files: 2026’s Massive 3-Million-Page Disclosure and Its Global Impact

- Union Budget 2026: Key Highlights, New Tax Slabs, and Sectoral Impact

- Toxic Movie Teaser Out: Rocking Star Returns as Raya in High-Octane ‘Fairytale for Grown-Ups’

- PDF4me is the Best Free All-in-One Tool of 2026

- Venezuela Crisis 2026