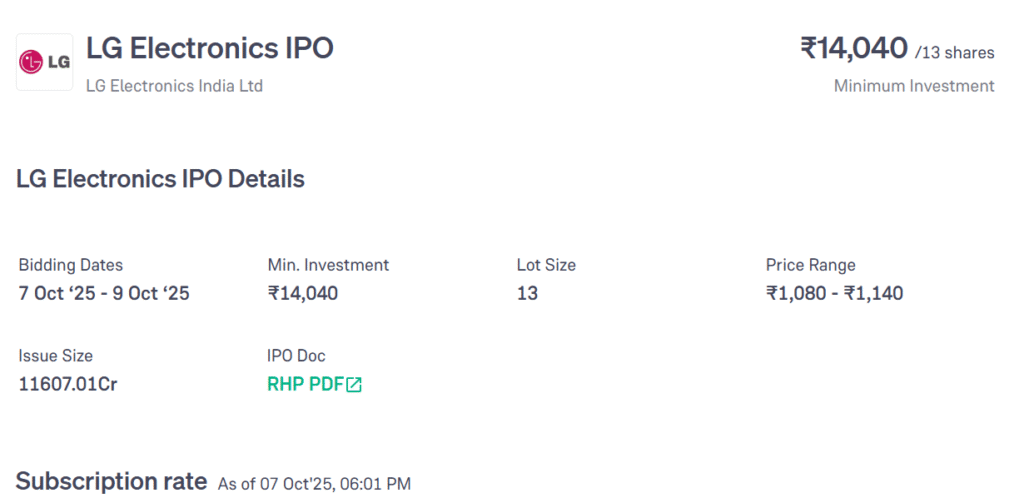

LG Electronics India IPO has launched its highly anticipated IPO valued at ₹11,607 crore, which opened for subscription on October 7, 2025, and will close on October 9, 2025. The IPO is a pure Offer for Sale (OFS) with the parent company, LG Electronics Inc., divesting 10.18 crore shares, bringing its stake down to about 85% after listing. The IPO price band is set between ₹1,080 to ₹1,140 per share, with a lot size of 13 shares. The listing is expected on October 14, 2025, on both NSE and BSE.

IPO Details and Financials

LG Electronics India is the Indian subsidiary of South Korean LG Electronics, operating since 1997 and a market leader in home appliances and consumer electronics. In FY 2025, the company recorded a revenue growth to approximately ₹24,367 crore, up 14.12% from the previous year, and net profit rose sharply by 45.8% to ₹2,203 crore. The company shows strong returns with a Return on Capital Employed (ROCE) of around 43% and Return on Net Worth (RoNW) of 37%.

Grey Market Premium (GMP) and Subscription Status

The IPO has seen robust investor interest, reflected in a strong grey market premium (GMP) of around 28%, indicating a potential listing price near ₹1,462 based on the upper price band. On its first day, the IPO was fully subscribed, showcasing healthy demand from non-institutional investors, institutional buyers, and retail investors alike.

Offering Structure and Investment Highlights

- The entire IPO is an offer for sale by the promoter; the company will not receive the funds.

- The price-to-earnings (P/E) ratio is around 35x FY25 earnings.

- Reserved share allocation stands at 50% for Qualified Institutional Buyers (QIBs), 15% for Non-Institutional Investors (NIIs), and 35% for Retail Individual Investors (RIIs).

- Strong backing from LG Electronics globally, with an extensive pan-India distribution network and locally adapted products.

- LG India is the market leader with consistent profitability and high brand loyalty.

- The manufacturing footprint is primarily in Noida and Pune, with the possibility of expansion.

Important Dates

- IPO Opening Date: October 7, 2025

- IPO Closing Date: October 9, 2025

- IPO Allotment Date: October 10, 2025

- Share Credit & Refunds: October 13, 2025

- Listing Date: October 14, 2025

This IPO stands as a significant milestone for LG India, offering investors an opportunity to partake in the growth of a leading consumer electronics brand with solid financials and an expansive market presence in India, benefiting from rising disposable incomes and increasing appliance penetration.

- Epstein Files: 2026’s Massive 3-Million-Page Disclosure and Its Global Impact

- Union Budget 2026: Key Highlights, New Tax Slabs, and Sectoral Impact

- Toxic Movie Teaser Out: Rocking Star Returns as Raya in High-Octane ‘Fairytale for Grown-Ups’

- PDF4me is the Best Free All-in-One Tool of 2026

- Venezuela Crisis 2026